does nj offer 529 tax deduction

To get started you can deposit 25. The plan NJBEST is offered through Franklin Templeton.

Nj College Affordability Act What You Need To Know Access Wealth

The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer.

. Our Savings Planner Tool Can Help With That. NJBEST 529 College Savings Plan. In 2022 New Jerseys plan NJBEST joins the majority of states that offer residents an income tax deduction or credit for contributions to the state plan.

Ad Tell Us About Your Savings Goal and Receive an Action Plan To Help Achieve It. Learn More With AARP. Managed and distributed by Franklin Distributors LLC an affiliate of Franklin.

More information is available on the creditdeduction. The Vanguard Group Inc serves as the Investment Manager and through its affiliate Vanguard Marketing Corporation markets and distributes the Plan. 2000 single or head of household or 4000 joint any state plan Connecticut.

But if the grandparents lived in Ohio they. The NJBEST 529 College Savings Plan is a direct-sold plan that comes with 014 081 fees and requires in-state residency. Learn more about Putnam 529 plans.

New for Tax Year 2022 The New Jersey College Affordability Act created three new income tax deductions for taxpayers with gross income under 200000. 5000 single 10000 joint. Many states provide an income tax deduction for contributing to a college savings plan including New York which provides a maximum annual 10000 deduction.

North Dakota Up to 5000 can be deducted per person annually. Some states do not offer state tax deductions or tax credits for K -12 tuition and other restrictions may apply. 36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary.

Only offered to account owners and their spouses. Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529 account for your child. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in.

It offers New Jersey residents enrolled at New Jersey colleges and schools tax-free scholarship opportunities and offers a variety of investment opportunities and investment portfolios. Start Your Tax Return Today. Thankfully NJ residents can open an account in any other state that lets them.

But it does offer these two key benefits. And Connecticut with a 10000 maximum. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan.

52 rows Depending on where you live or where you started your 529 plan you could be eligible for one of these benefits. Best 529 Plans in New Jersey. Does NJ offer 529 tax deduction.

Start saving for college. NJBEST had previously been criticized. 5000 single 10000 joint.

Ohio Contributions up to 4000 can be deducted per beneficiary per year. New York Can deduct up to 5000 per year per person. Beginning in tax year 2022 New Jersey will join its peers in allowing a state income tax deduction of up to.

New Jersey is the 35th state to offer an income tax benefit for residents who contribute to a 529 plan. Direct this New Jersey 529 plan can be purchased directly from the state. NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority HESAA.

NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. Max refund is guaranteed and 100 accurate. If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit.

5000 per parent 10000 joint 5-year carryforward on excess contributions. Use Our Free College Savings Calculator And Start Saving For Your Childs Future. Married grandparents in Nebraska who want to contribute 15000 toward college savings for five grandchildren would only be able to deduct 10000 from state taxable income.

Ad All Major Tax Situations Are Supported for Free. Ascensus Broker Dealer Services Inc serves as Program Manager and has overall. Ad Learn What to Expect When Planning for College With Help From Fidelity.

Some states do have income taxes but no 529 plan tax deduction. 36 rows The most common benefit offered is a state income tax deduction for 529 plan. Pennsylvania with a 30000 maximum.

New Mexico All contributions to in-state 529 plans are deductible. New Jerseys plan doesnt offer much. Free means free and IRS e-file is included.

Putting Your Goal in Writing Will Help You Reach Your Savings Goal.

Fact Sheets Flyers Mainstreaming Medical Care Programs The Arc Of New Jersey

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

Able Account Go Bag Resources The Arc Of New Jersey Family Institute

New Jersey 529 Plan And College Savings Options Njbest

N J S College Savings Plan Is One Of The Worst In The Nation It S About To Get Way Better State Says Nj Com

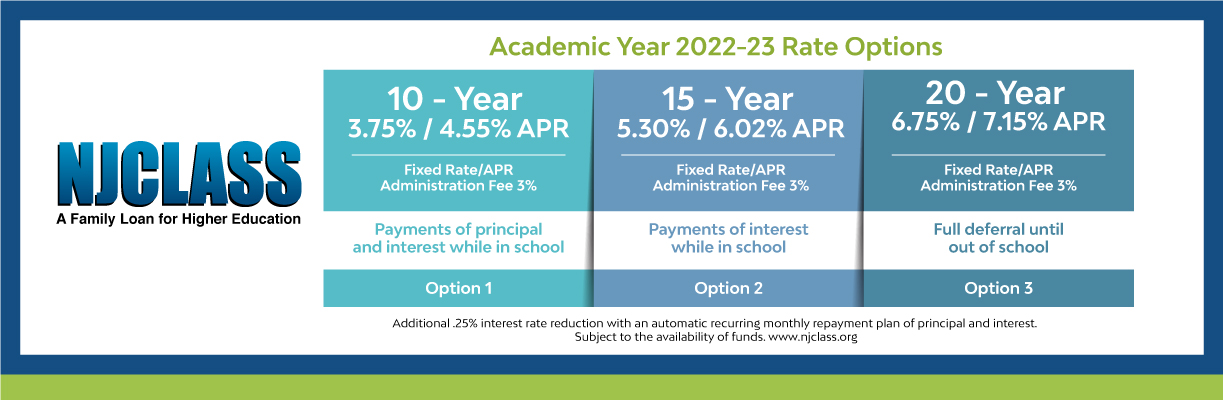

Home New Jersey Student Financial Aid Hesaa

Exploring The Secure Act New Jersey Business Magazine

Follow Nj Hesaa S Njhesaa Latest Tweets Twitter

Clueless About 529 Plans Here S A Guide Nj Com

New Year Brings Tax Breaks For Student Borrowers New Jersey Monitor

Covid19 Information Resources Berkeley Heights Township Nj

New Jersey 529 Plan And College Savings Options Njbest

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

New Year Brings Tax Breaks For Student Borrowers New Jersey Monitor

New Jersey Deductions For Higher Education Expenses And Savings Kulzer Dipadova P A

N J Students Now Eligible For 3k Scholarships As State Revises 529 College Saving Plan Rules Nj Com