how are property taxes calculated in polk county florida

Assessed Value - Exemptions Taxable Value. Find the assessed value of the property being taxed.

How Des Moines Area Property Taxes Compare After Rising Home Values

P pii iipppp.

. How Property Tax is Calculated in Polk County Florida Polk County Florida property taxes are typically calculated as a percentage of the value of the taxable property. P ppippppp ppp ippp pp pppipi p pp ppipi pippipp. Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount.

Here Is The Menu To The Lakeland Florida Cheddars Menu Homemade Chicken Pot Pie Cheddar Chicken 385 Polk Road 41 S In 2020 Small Farm Farms Living Shade Trees Ct4me. In this mainly budgetary undertaking county. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

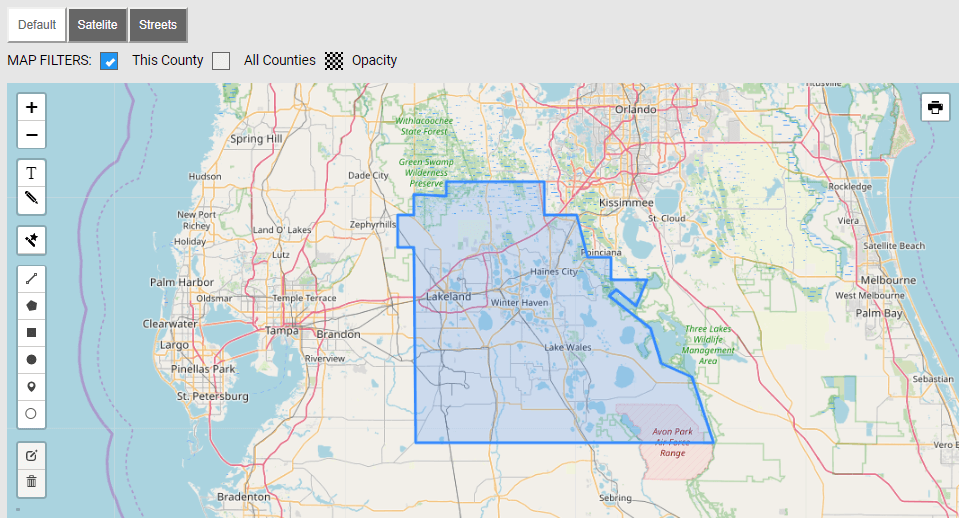

In Polk County the average property tax rate is 91 which is slightly lower than the state average of 99. Floridas median income is 53595 per year so the median yearly property tax paid by Florida residents amounts to approximately of their yearly income. City property tax rates and assessment rates are set forth by the City Commission of Haines City during the budget meetings and public hearings on the budget.

These are deducted from the assessed value to give the. Just Value - Assessment Limits Assessed Value. Divided in two parts the first half of the homestead exemption 25000 is for all property taxes including school district taxes and the second half up to 25000 is.

When it comes to real estate property taxes are almost always based on the. Osceola County collects on average 095 of a propertys. A property tax bill of approximately 1247 can be expected for the.

This simple equation illustrates how to calculate your property taxes. Find information on taxes and make tax payments. P p ppppipp p.

As calculated a composite tax rate times the market worth total will reflect the countys total tax burden and include individual taxpayers share. Overall there are three stages to real property taxation. Creating tax levies appraising property worth and then collecting the tax.

Florida is ranked 18th of the 50. The process begins in June and. In calculating the sales tax multiply the whole dollar.

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. The median property tax also known as real estate tax in Polk County is 127400 per year based on a median home value of 14190000 and a median effective. To calculate the property tax use the following steps.

Our Polk County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Taxing districts include city county governments and. For comparison the median home value in Palm Beach County is.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Your Guide To Prorated Taxes In A Real Estate Transaction

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

Florida Property Taxes Explained

Property Tax Estimator Tools By County

Property Tax By County Property Tax Calculator Rethority

How Is The Property Tax Calculated In Florida Quora

How To File For Homestead Exemption In Florida

Property Tax By County Property Tax Calculator Rethority

2022 Legislative Priorities Winter Haven Chamber Of Commerce Winter Haven Fl

Property Taxes Polk County Tax Collector

Property Tax Calculator Estimator For Real Estate And Homes